Optimize your business’s ROI. Power out higher profits.

There are many types of classic investments in our world from real estate and investing in gold, to stocks or art.

You have no control over the economy - inflation, market sentiment and taxes. But… you have control of your products, marketing campaigns and internal procedures. This will allow you to optimize ROI and enjoy higher profits.

Maybe your business is a startup and you’re receiving investment from an angel investor, perhaps a venture capitalist is investing in the early stages of growth, maybe you or your family are committing a small amount of personal capital towards your business or your bank is providing you with a loan.

Whoever the investor is, they will want to calculate how much money they lost or gained relative to the amount that was invested. The investor has committed capital to receive financial return. Any return is from the net profit the business makes and is a mark of the efficiency of investing capital into the venture.

ROI is useful for measuring the success of your business over time and helping you to make calculated future business decisions, irrespective of your business size or industry. It’s important to know whether you are getting your money’s worth from the activities you are undertaking.

By calculating ROI, you will understand your business’s performance and identify areas for improvement in order to attain your goals.

So… it’s of the utmost importance that you, as a business owner, know what ROI means and how to calculate it.

What is ROI (Return on Investment)?

ROI is an indicator that describes the percentage return on investment. It allows you to evaluate your company’s profitability in a simple and objective way. It also allows you to compare different investments with each other.

How is it calculated?

ROI is calculated based on the following formula:

ROI = (profit/cost of investment) * 100

The higher ROI you achieve in your business, the better. This makes your investments more profitable, and more attractive for existing or future investors.

What does a ROI look like?

In the table below, you will find three scenarios:

-

A business purchases a rental property for £500,000 and rents it out for £2500 per month. Let’s assume it’s rented for a full 12 months.

-

A business invests £300,000 in the stock market for £300,000 and increases the capital within 12 months to £343,000.

-

A business spends £120,000 on marketing over 12 months, which generates sales of £412,600.

|

Type of investment |

Profit |

Cost |

ROI |

|

£30,000 |

£500,000 |

6% |

|

£43,000 |

£300,000 |

14.3% |

|

£412,000 |

£120,000 |

343.3% |

The above table illustrates each business scenario’s ROI- how much profit they have earned as a percentage of initial investment over a 12-month period.

The marketing campaign’s ROI in this scenario clearly outclasses the competition.

But… There is a common mistake marketers and entrepreneurs make when calculating ROI.

ROI vs. ROAS (Return On Ad Spend) in business - what do you need to know?

-

When calculating ROI, you should take into consideration all costs associated with the investment.

-

The profit should be reduced by tax.

You will then calculate an accurate ROI!

ROI is often confused with ROAS. ROAS describes the return on advertising spend and is given by default by advertising systems (after prior configuration) like Facebook. Therefore, using it is accessible.

ROAS describes the ratio of revenue to advertising costs. It can be calculated from the following formula:

ROAS = (revenue/cost of advertising) * 100

What are the disadvantages of ROAS?

ROAS does not include costs such as:

-

Margin.

-

Service costs.

-

Payment processing costs.

-

Taxes.

How do you calculate ROI taking into account costs?

To calculate ROI from marketing activities, determine the margin, all costs incurred related to the activity, and the tax to be paid.

Let’s go back to scenario 3 above.

Let’s assume that:

The margin is 95% - the entrepreneur sold a course, while 5% is the commission cost of the payment system and the platform for the course.

The fixed costs are £1500 for advertising service and £500 for tools per month.

VAT is 20%.

Fixed costs then rise to £24,000 per year. And the total costs increase from £120,000 (for advertising) to the level of £144,000.

VAT has to be deducted from the income like this; (£412,000 x 0.95 (profit margin) - £144,000) x 0.20 = £49,840

Net profit (income minus costs and tax) can be calculated this way; £412,000 x 0.95 (profit margin) - £144,000 - £49,840 = £197,560

We then divide the net profit by the total costs (197,560/144,000) to calculate ROI at 137.19%

This is very different to the ROAS calculation of 343.3% without taking into consideration ROI, it is still a very good result. On the other hand, it is significantly different from the ROAS.

The disparity between these ratios is shown in the table below:

|

Income |

£412,000 |

£989, 642 |

£1,335, 415 |

|

Margin |

95% |

95% |

95% |

|

Advertising costs |

£120,000 |

£120, 000 |

£120,000 |

|

Services and tool costs |

£24,000 |

£24,000 |

£24,000 |

|

Total costs |

£144,000 |

£144,000 |

£144,000 |

|

VAT |

£49,840 |

£159,232 |

£224,929 |

|

Net profit |

£197,560 |

£636,928 |

£899,715 |

|

ROAS |

343.33% |

824.70% |

1112.85% |

|

ROI |

137.19% |

442.31% |

624.80% |

The difference between these two calculations will be greater the lower the profit margin of the products. In the example above, we are discussing a course sold on its own platform. This results in a very high profit margin of 95%, in the case of physical products, however, it can be much lower.

Business ROI optimization - what should you pay attention to?

The above simulation shows that revenue and profit optimization should go hand in hand with cost optimization. By reducing expenses by a few percentage points, you can significantly increase ROI. Especially when the ROAS is at a high level.

You can read more about optimizing individual factors in business in our article on exponential growth

Note that in the above example we are analyzing ROI from an annual perspective. The mistake many entrepreneurs make is that they focus only on the profit a campaign generates in the short term. Long term profit analysis is key.

Self-financing marketing funnel

It’s worth aiming for a campaign to generate immediate income. The income from a self-financing marketing funnel covers the costs and allows for further investment.

For example:

A marketing campaign has total costs of £10,000, which generates £35,000 in revenue (ROAS 350%) and £19,250 in income (ROI: 192.50%). Thus, the profits from the campaign cover all costs and you gain capital for further investments.

What does spectacular growth look like in practice?

Optimizing marketing funnels, costs and reinvestment allows you to grow dynamically. This allows you to achieve spectacular growth, the company is increasing and changing to scale.

Three great examples of spectacular growth are Amazon, Facebook and Netflix.

Amazon

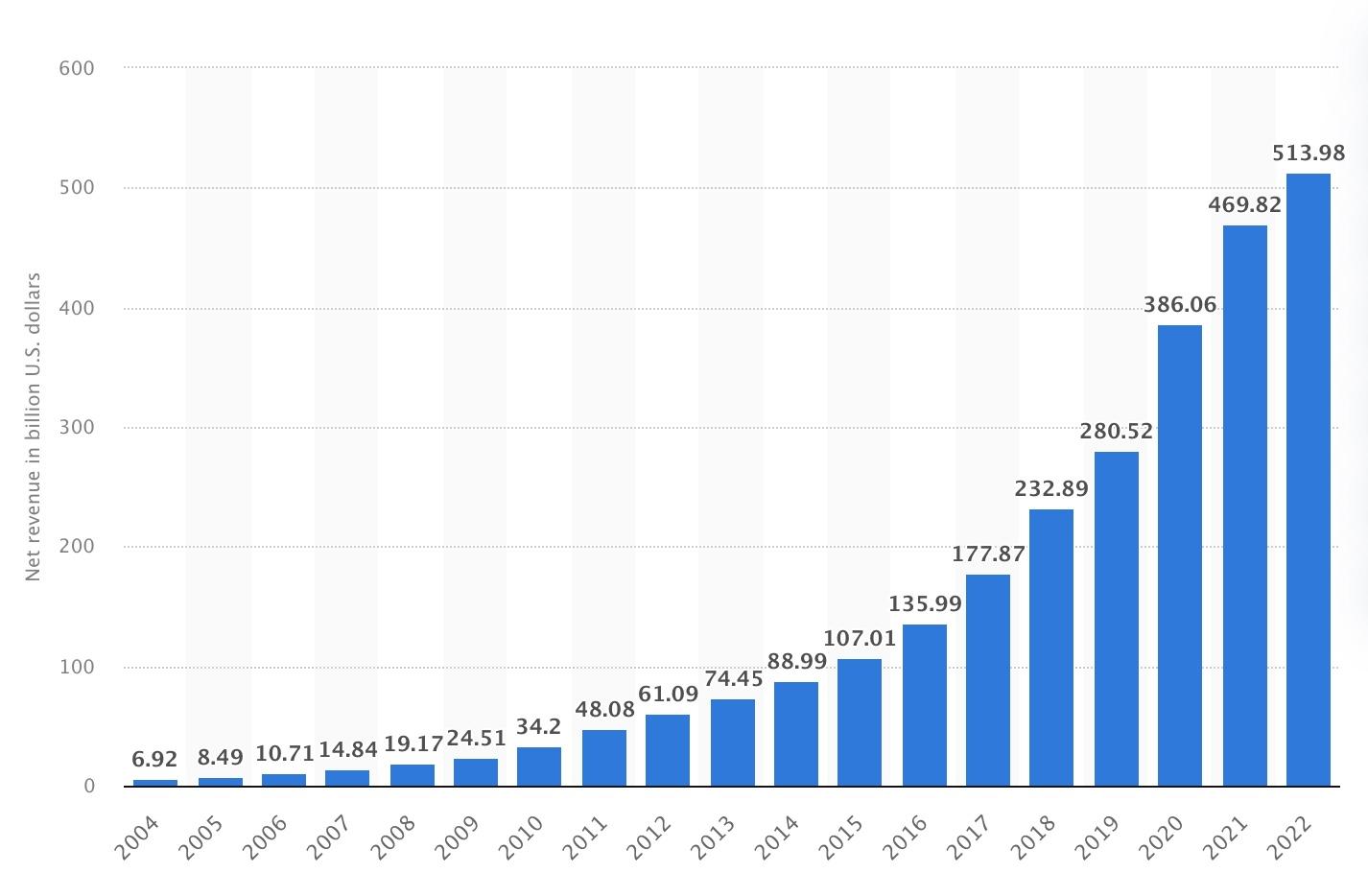

Here is Amazon’s annual sales chart from 2004-2022:

Source: statista

Amazon’s average annual growth is “only” 27.29%- but that is enough to grow from 6.92 billion to over 500 billion in sales per year over the course of18 years.

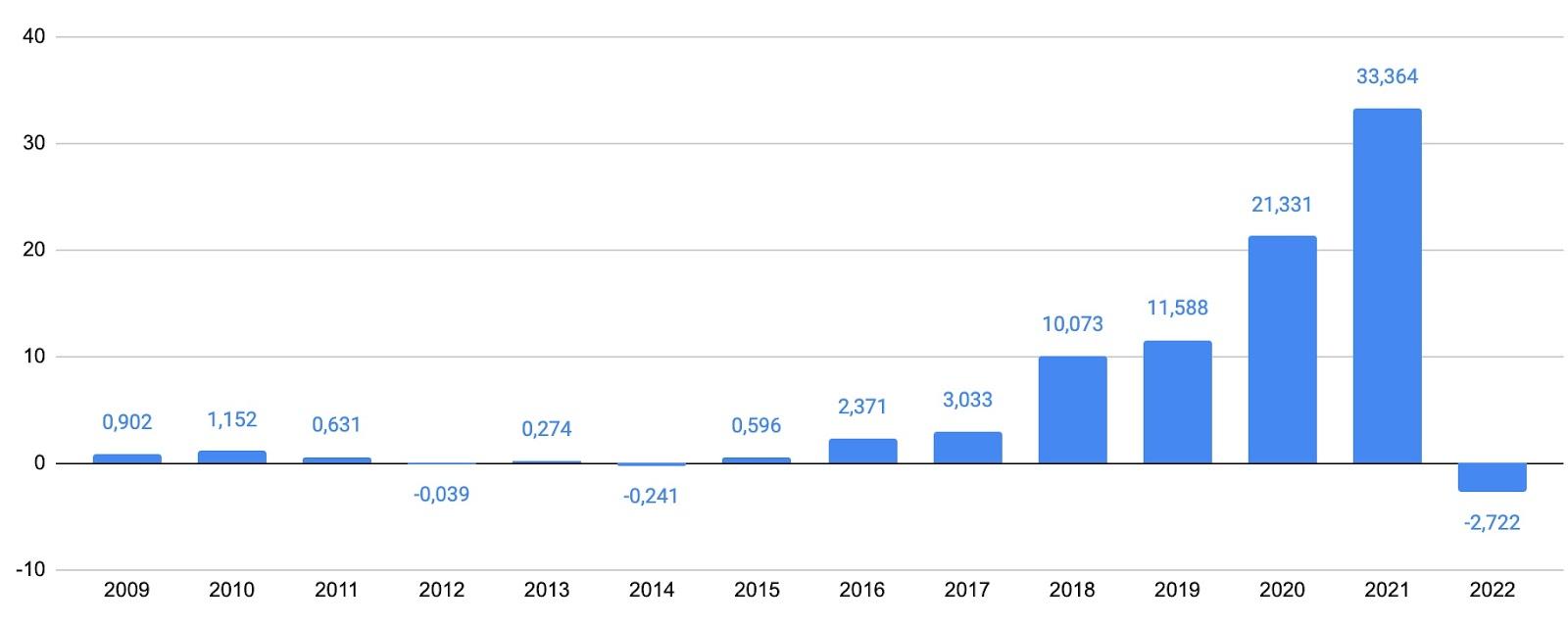

At the same time, as you might have read earlier, you should also look at Amazon’s annual net income. Below is a chart compiled from data from the macrotrends portal:

You see here that, although annual sales grew from 24.5 billion to more than 100 billion between 2009 and 2015, their annual net income remained at a similar level.

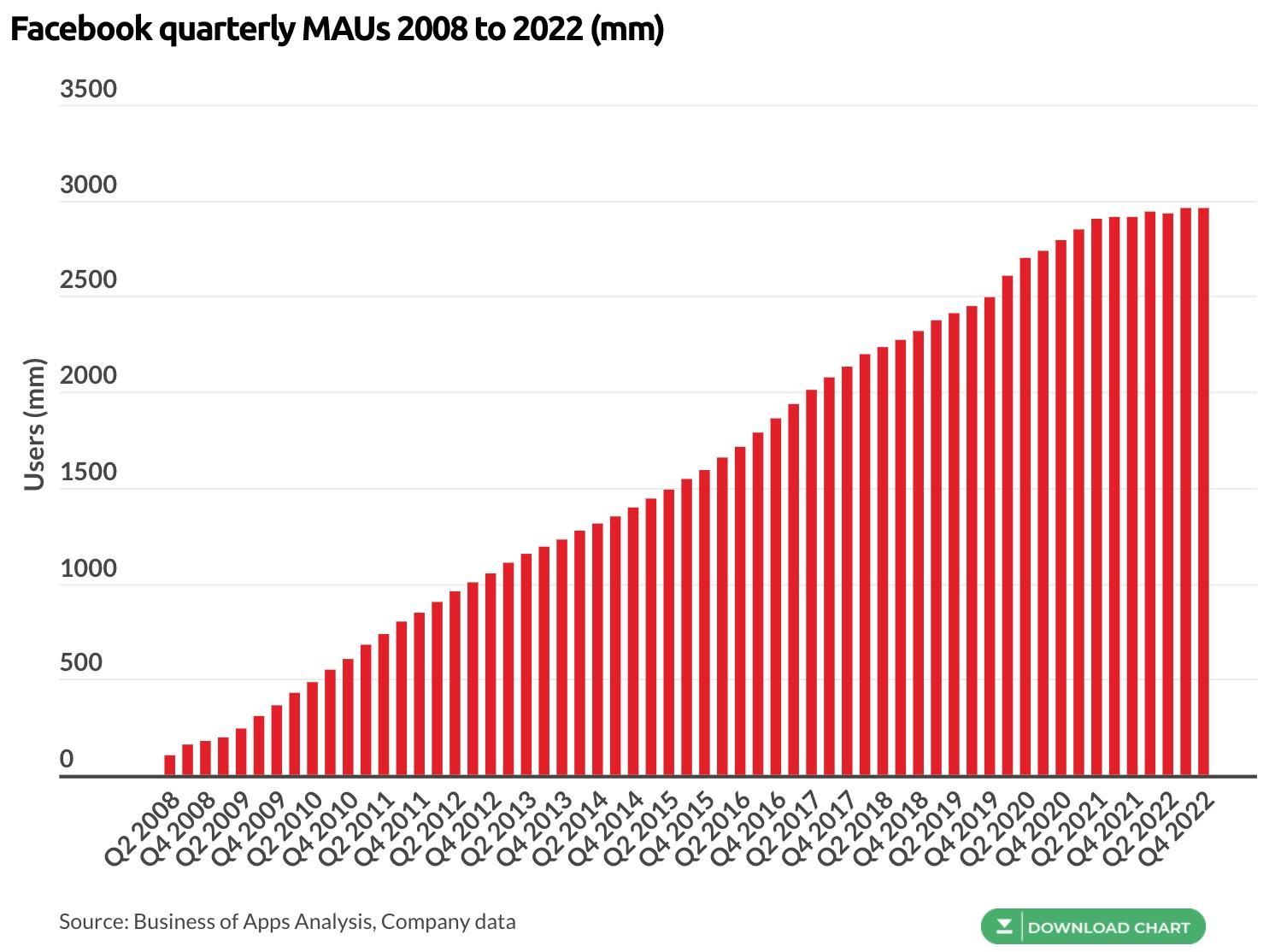

Facebook, which was originally intended only for Harvard students, became a giant. In 2004, it had one million active users (source), four years later it had 100 million, and in 2012, it crossed the barrier of one billion accounts.

The growth between 2008 and 2023 is brilliantly shown in a chart from businessofapps:

How does this translate into revenue?

Information from the same link at businessofapps details that Facebook’s revenue increased from 345 million in the first quarter of 2010 to more than 32 billion in Q4 of 2022. That’s almost a 100-fold increase in 12 years. Facebook closed 2022 with revenue of 116.6 billion. In 2010, it was 1.97 billion!

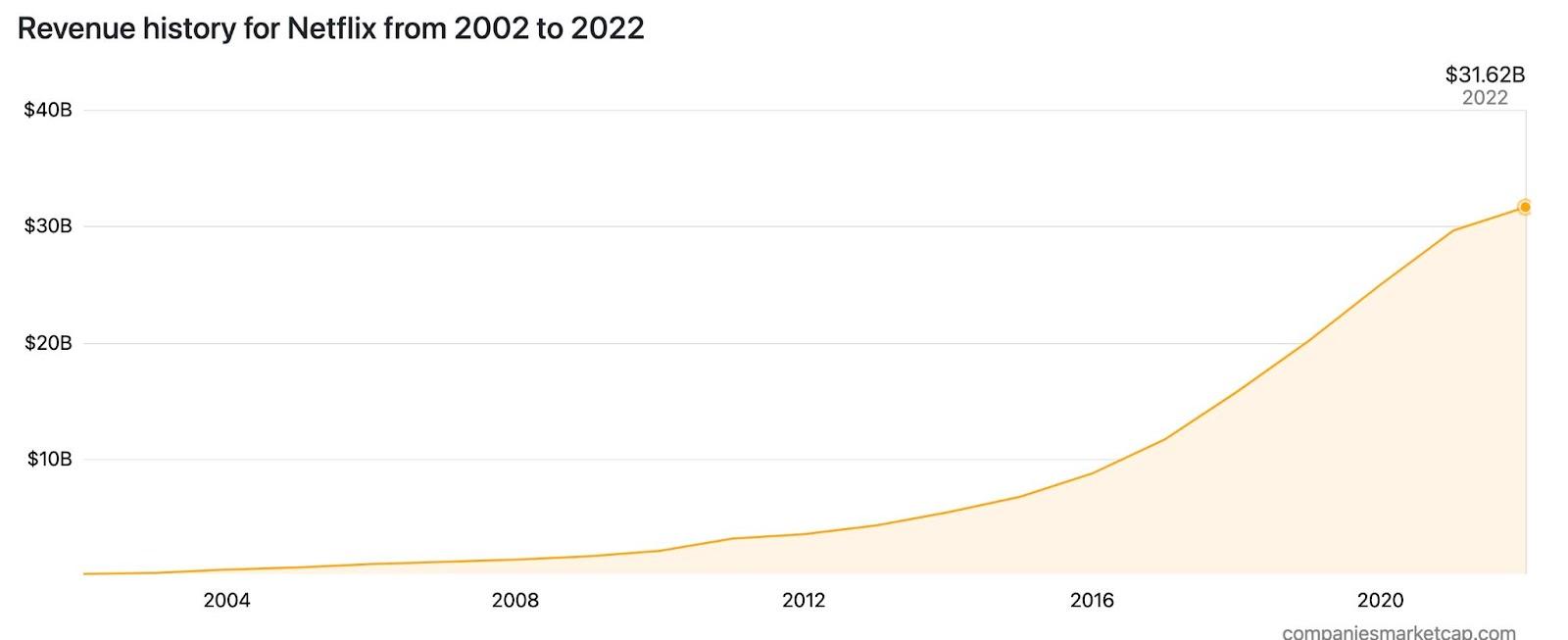

Netflix

Neflix is the current leader in the streaming industry- as indicated by data from companiesmarketcap The company’s revenue reached 150 million in 2002, more than 3.5 billion in 2012 and more than 31 billion in 2022- an average annual growth rate of more than 30%:

Source: companiesmarketcap

But… Netflix’s history differs from Amazon and Facebook.

The history of Netflix begins not in 2002, but in 1997. During its initial years, the company functioned as a remote movie rental service that loaned physical discs. The streaming business began ten years later in 2007.

This shows that if you want to grow your business, you need to adapt to a changing world and a change in consumer demand.

How do you use ROI to optimize your marketing efforts?

Firstly, start measuring ROAS and ROI. Monitor the revenue from marketing activities and all incurred costs.

Watch the ROI in the short term (profit made from a given campaign). At the same time, also monitor the LTV (LifeTime Value) of individual customers and observe what kind of ROI you achieve over several months, or even, years.

The ideal situation is the ROI from marketing campaigns exceeding 100%. Then you are talking about self-financing marketing funnels- the profits your campaigns generate fully cover the costs.

The Takeaways

-

Running your business efficiently can yield a much higher return on investment than many types of classic investments such as real estate, gold, stocks and art and will allow you to optimize ROI and enjoy higher profits.

-

Seeking external investors is possible at many different stages of business growth. If you do seek external investors, they will want to calculate how much money is lost or gained relative to the amount that was initially invested. Investors have committed capital with the expectation of receiving financial return. Any return is from the net profit the business makes and is a mark of the efficiency of investing capital in the venture. It is also crucial that you monitor this information for your own business success, whether or not investors are involved.

-

Control your offerings, marketing campaigns and internal procedures while optimizing your business’s ROI.

-

Take the time to understand what ROI is, how it is accurately calculated using the given formula, and examine case studies that show ROI in real time over given time periods.

As British-born American author and inspirational speaker, Simon Sinek, says, “I cannot tell you on a day-to-day basis that there’s a return on investment. I can tell you if you stick with it, absolutely in a few months, things will start to change. It starts to change slowly. Things start to get a little easier. As the momentum builds, it becomes bigger and bigger.”

Richard Pulitzer