How do our knowledge and attitude affect the achievement of financial freedom?

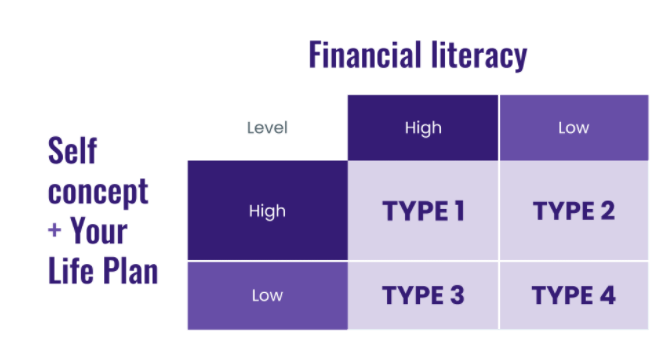

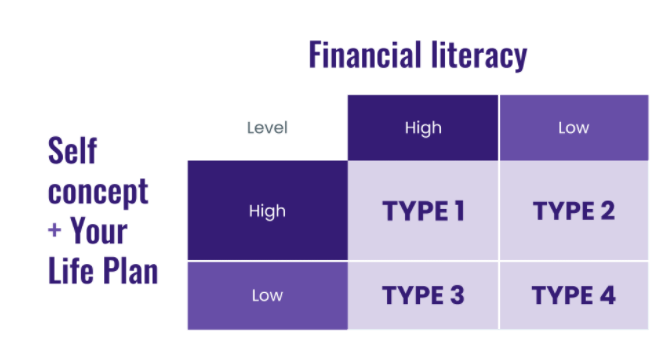

The cornerstone of financial success is sound financial knowledge and a thorough plan for life. The combination of these two elements produces four types of people.

Let’s start with type 4 – This is an individual with low financial knowledge having no idea about themselves as a person. Such people always find themselves in real trouble because not only do they know anything about the nature of money, but they also have no idea what they want to do with their lives.

Type 3 – This is an individual who is able to generate a lot of money and even quite quickly because of a high level of financial knowledge, and then just as quickly ‘getting rid’ of what they have earned because of a lack of clear direction in life and life goals. If you do not have clear life goals, the money will not ‘stick’ to you.

Type 2 – This is an individual with a very solid life plan and life goals. This is a person who, although he or she has no knowledge of the nature of money yet, will soon come to the conclusion that he or she needs to learn vitally about finances in order to achieve his or her life goals.

Type 1 – This is an individual with a lot of financial knowledge and a high level of self-esteem, and an accurate idea of themselves. Someone like this not only knows how to make money, but also knows how to protect their wealth, multiply it, and then pass on their legacy to the next generation.

Take some time now to figure out what type of person you are!

POINTS TO CONSIDER:

Why are you where you are in your life right now? What has happened (or what has NOT happened) in your life that you are where you are? Are you happy/satisfied with what you have just discovered? In turn, if you want to change something significant in your life and finances, what would be your first step to achieve that? (And then what would be the next two steps?)

Sound financial knowledge and an awareness of your life purpose are fundamental to financial success. People who know money but don’t know where they are going in life will quickly spend the money they earn. On the other hand, those who have a clear goal but still lack financial knowledge will quickly learn and start making good money. To achieve financial independence, you need to be aware of where you are in life today and what your purpose in life is. Additionally, improve your financial knowledge – start today and don’t stop.